24+ utah payroll calculator

The percentage method and the aggregate method. Web Use our Utah Payroll Calculator All you have to do is enter wage and W-4 information for each employee and our calculator will do the rest.

.jpg)

The Arbors Apartments 1000 E 17th Street South Sioux City Ne Rentcafe

The standard FUTA tax rate.

. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. It will figure out your. Web Step 2.

If the employees annual. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Enter an amount for dependentsThe old W4 used to ask for the number of dependents.

Your average tax rate is 1167 and your marginal tax rate is 22. Web There are two ways to calculate taxes on bonuses. If an employee works.

Web On-call pay is calculated at a rate of one hour for every 12 hours that an employee is on-call maximum of 24 hours rounded to the nearest two decimal points. Your household income location filing status and number of. All-In-One Payroll Solutions Designed To Help Your Company Grow.

If your business is new you need to register on the Utah OneStop Online Business Registration System website. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web Need help calculating paychecks.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Ad Well file your 1099s new hire reports. Heres how to calculate it.

Web The Utah Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Utah. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Utah. Register your business with the State of Utah.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. A single filer will make 52358 if he earns 69000 per. Get 3 Months Free Payroll.

Well do the math for youall you need. Add W-2 employees at any time. 125000 married filing jointly Total.

Web Utah Utah Gross-Up Calculator Change state Use this Utah gross pay calculator to gross up wages based on net pay. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Utah. For example if an employee earns 1500 per week the.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Well file your 1099s new hire reports.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. For example if an employee receives 500 in take-home.

Web If this employees pay frequency is semi-monthly the calculation is. Free Unbiased Reviews Top Picks. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

How much do you make after taxes in Utah. Web Utah Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Add W-2 employees at any time.

The calculator on this page uses the percentage method. Web Residents of Utah need to pay a flat income tax rate of 495. Simply enter their federal and state W-4.

Web Help employers in Utah to calculate Paycheck amounts for multiple employees instantly using our Utah Paycheck Calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. Web Utah Income Tax Calculator 2022-2023 If you make 70000 a year living in Utah you will be taxed 11594.

The new W4 asks for a dollar amount. Ad Compare This Years Top 5 Free Payroll Software. Web 24 payroll calculator utah Rabu 22 Februari 2023 Web Utah Hourly Paycheck and Payroll Calculator Need help calculating paychecks.

52000 24 payrolls 216667 gross pay What is the difference between bi-weekly and semi-monthly. Web Paycheck Details Payroll Tax Rates Social Security tax rate 62 Medicare tax rate 145 09 over 200000 single. Make The Switch To ADP.

All Services Backed by Tax Guarantee. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Ad Fast Easy Affordable Small Business Payroll By ADP.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

1765 Foothill Rd Gardnerville Nv 89460 Realtor Com

Paycheck Calculator Utah Ut 2023 Hourly Salary

Galileo Satellite Navigation Wikipedia

Book Surf Camps France 2022 Online Pure Surf Camps

Expected Family Contribution Efc Calculator Finaid

Samuel J Greear

Fence News January 2023 By Fencenewsusa Issuu

Income Calculators Pay Check Salary Wage Time Sheet

Pdf Modeling Long Term Health Outcomes Of Patients With Cystic Fibrosis Homozygous For F508del Cftr Treated With Lumacaftor Ivacaftor

Operator Functional State Assessment Nato Research

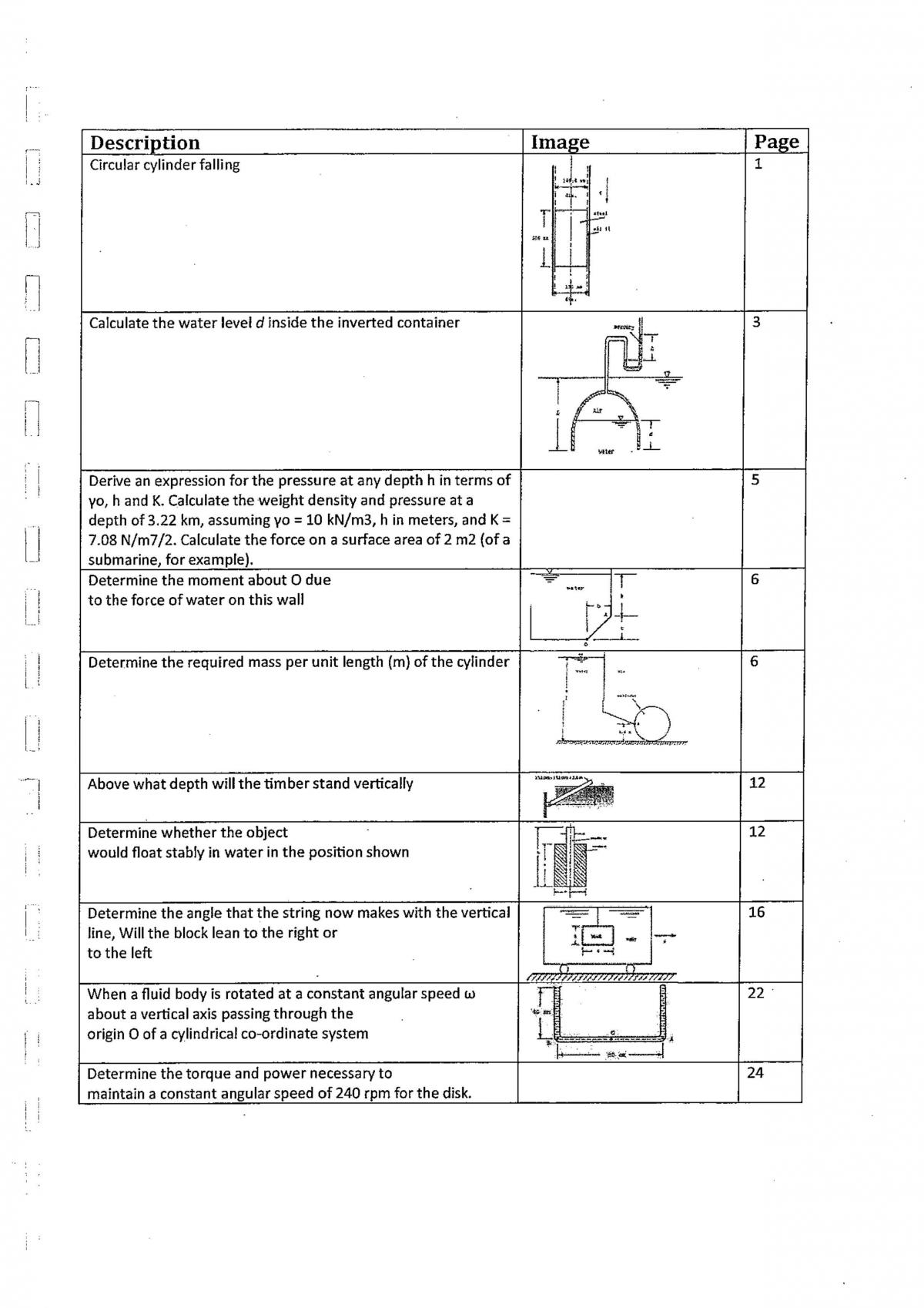

Fluid Mechanics Bible 48641 Fluid Mechanics Uts Thinkswap

Europe River Cruise 2024 Preview By Scenic Uk Issuu

Weekly Time Sheet Calculator With 4 In Out Blocks Per Day

Gateway B2 Wb Pdf Pdf

Qvpr Jeljkabbm

Galileo Satellite Navigation Wikipedia

Pdf Review Of Apprenticeships Research A Summary Of Research Published Since 2010